Table of Content

Apply for a Carter’s credit card and receive 25% off first purchase when you use your card. This eligibility check won't affect your credit score. No thanks, we’ll leave those to the credit card companies. At Affirm, we like to keep it real—and that means no fees, no gotchas, and no regrets. Online, in stores, wherever you love to shop—pay over time just about anywhere with the Affirm app.

You can make monthly payments through their WebBank/Fingerhut FreshStart Program by simply placing an order of $50 or more. Your order ships once your $30 down payment is processed. Getting an approval for buy now pay later financing on electronics and appliances purchases is easy and can be done in just a few minutes. You will know if you are approved for the financing option instantly after completing the application process.

New customers

Research from Baymard Institute shows that retailers are losing as much as 6% of their potential sales due to a lack of enough payment options. Yes, monthly payments and buy now pay later are the same thing. No credit payment plans are a great way to finance your purchases without paying any interest.

You must compare different catalogues and online merchants to find the best rate. Check out our range of credit catalogues and stores which offer a huge range of products. You also learned how to use the apps, which ones affect your credit score, and which ones do not. Create an account with Splitit and connect your card. Once you have successfully created an account, you will be able to shop on Splitit supported merchant websites and checkout using the Splitit option. There are various item categories to choose from, including electronics, furniture, appliances, fashion, beauty products, etc.

Where can I shop with Pay in 4 or Pay Monthly?

Montgomery Ward says “Yes” and frequently provides credit accounts to consumers when other retailers have said “No”! Get quick approval up to $100 credit with payments of only $10 per month. They offer a giant selection of brand name items including Sony, Mattel, Samsung, Fisher-Price, Hoover, KitchenAid, New Balance, Conair and more. Their products are curated from top brands, and they often offer several amazing deals. Payment amounts cover design/development only; hosting, domain name registration and other services are invoiced spearately on a monthly basis.

Zebit has pre-arranged agreements with employers to avail payroll information of their employees to assess each employee’s creditworthiness. We share the best personal finance resources for your life such as retirement, real estate, budgeting, making & saving money, and much more. That’s going to affect a lot of families bottom lines.

PAYMENT PLANS FOR

Online shoppers have long been attracted to tools that make purchases easier and more affordable. As a result, consumer financing has seen an explosion of adoption over the past two years in the eCommerce market. The ability to pay in installments has helped merchants drive sales and increase the average cart size of the customers they convert. FlexShopper also offers a lease-to-own payment plan, where you can purchase items on credit and pay for them in weekly instalments.

Unlike most rent-to-own sites, we also offer in-store pickup on many of the products you can find on our site, from appliances to electronics and furniture. Options depend only on whether we can find another retailer with it in stock. Do you have more questions about pay in installments for online shopping? Buy now, pay later lets customers spread the cost of their purchases over time, allowing them to maximize their budgets and increase their purchasing power. Paying after delivery allows you to try before you buy and is the easiest way to shop online.

Checking if the site connection is secure

Shop Apple refurbished products backed by a one-year warranty. Easily and securely spend, send, and manage your transactions—all in one place. Download the app on your phone or sign up for free online. Skeps has a solution to improve your results—whether you are comfortably established or just beginning your point of sale lending journey. We are proud to provide a frictionless end-to-end financing experience through our next-gen point of sale financing platform. Give your business the Skeps advantage and reach out today.

Complete the payment 30 days after purchase at no added cost. Report returns directly in our app and only pay for the items that you keep. Our transparent credit options offered in partnership with WebBank, member FDIC, give you flexible financing you need to seamlessly shop larger purchases. Shop at your favorite stores—in our app, at your local mall, or anywhere online—then, checkout with Klarna. From finding what you love, to paying over time, we make every step smoooth. However, there are both advantages and disadvantages to online shopping to consider, prior to applying with different retailers.

Get Approved Instantly -RTBShopper is an online catalog with tens of thousands of buy now pay later productsincluding furniture, electronics, Apple products and much more! RTBShopper helps customers access benefits including fast shipping and easy online monthly payments. More expensive – we previously mentioned that using BNPL apps is a cheaper option compared to using credit cards. Most apps offer interest-free payments for deferred payments of up 30 days or four installments every two weeks. Other apps offer consumers the option to purchase expensive items and pay over more extended periods, say up to 48 months. However, for these payment plans, interest rates of up to 30% are usually charged.

America’s largest family owned department store stated on their website. They offer their own credit card that rewards you for being a cardholder. You can receive 15% off your first day’s purchase when using your new Boscov’s credit card within 30 days of opening. Additionally, using buy now pay later clothing catalogs are also a great way for shoppers to buy now pay later online if you are unable to leave the house. We have payment plans tailored to fit budgets for all types of people.

The Wisconsin Cheeseman Credit Card offers payment plans starting at $10 a month. There is no annual fee either with Wisconsin Cheeseman Credit. Most notably found in the back pocket of airline seats, everyone who has flown on an airplane is familiar with this buy now pay later catalog.

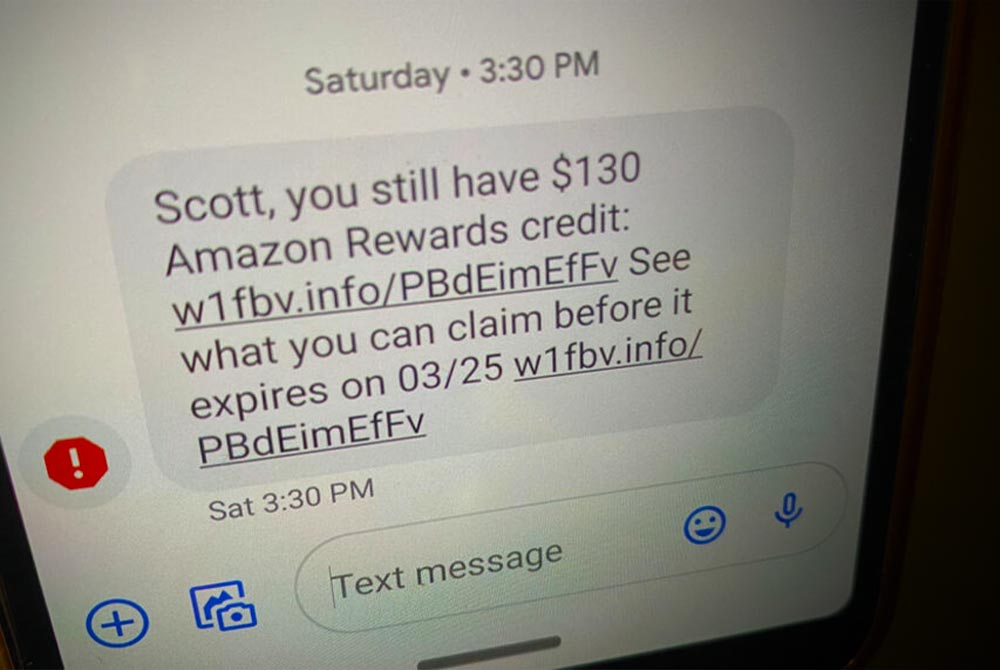

Like scams, other threats such as identity theft or having your credit card information stolen is a possibility. Some will also have a buy now and pay later plan for larger purchases such as sofas and beds, whereby you can pay nothing for up to 3 years. As such a bad credit catalogue might be your best option, however if you've not applied before we'd suggest you try a normal catalogue first.

Keep up with Klarna.

Not a lot of stores offer layaways anymore, however Kmart still does. Additionally, some of these deferred payment sites are great credit building tools if you are trying to repair your credit and you need to build credit history. Buy now pay later flooring is what Lumber Liquidators pride themselves on.

No comments:

Post a Comment